In a significant update, the United Nations has revised its growth projections for India’s economy in 2024, forecasting an expansion close to 7%. This upward revision underscores the strength of India’s public investment and resilient private consumption, setting a positive tone for the country’s economic prospects.

UN’s Robust Economic Outlook for India

The United Nations’ mid-2024 World Economic Situation and Prospects (WESP) report, released recently, highlights that India’s economy is expected to grow by 6.9% in 2024, up from an earlier forecast of 6.2%. The forecast for 2025 remains stable at 6.6%. The key drivers of this growth include strong public investment and resilient private consumption, despite challenges posed by subdued external demand.

Strong Public Investment and Private Consumption

India’s economic resilience is attributed to robust public investment initiatives and a buoyant private consumption sector. These factors have significantly contributed to the upward revision of the growth forecast. The report also mentions that while merchandise export growth may be weighed down by external demand, sectors like pharmaceuticals and chemicals are poised for strong export performance.

Inflation Trends and Fiscal Policies

The update from the UN also sheds light on inflation trends in India. Consumer price inflation is projected to decrease from 5.6% in 2023 to 4.5% in 2024, aligning with the central bank’s medium-term target range of 2% to 6%. This decline in inflation is a positive indicator for economic stability and consumer confidence. Additionally, India’s government remains committed to reducing the fiscal deficit while increasing capital investment, ensuring sustainable economic growth.

Regional Economic Outlook in South Asia

The report provides an optimistic outlook for South Asia, largely driven by India’s strong economic performance. South Asia’s regional GDP is projected to grow by 5.8% in 2024, an upward revision of 0.6 percentage points since January. However, the region continues to face challenges such as tight financial conditions, fiscal and external imbalances, and potential energy price increases due to geopolitical tensions.

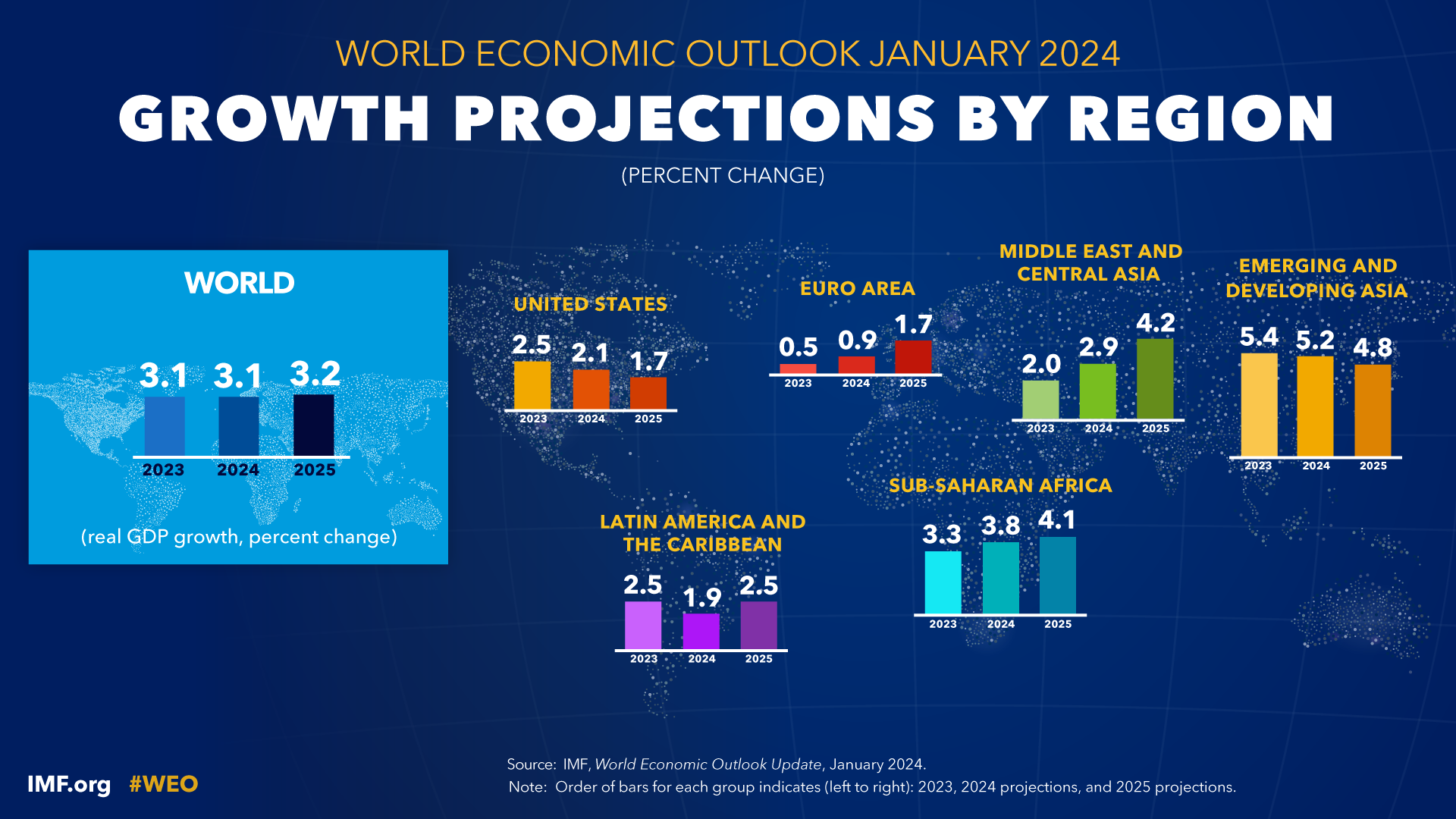

Global Economic Prospects

On a global scale, the UN has also revised its economic growth forecast. The world economy is now expected to grow by 2.7% in 2024, up from the previous forecast of 2.4%, and by 2.8% in 2025. This positive adjustment reflects improved economic outlooks in the United States and several large emerging economies, including Brazil, India, and Russia.

Challenges and Risks

Despite the positive projections, the report cautions against several risks that could affect global and regional economic performance. These include persistent geopolitical tensions, disruptions in trade routes, and higher borrowing costs. The ongoing conflict in Gaza and disruptions in the Red Sea are particularly noted as potential threats to economic stability. Moreover, the lingering effects of high inflation, especially in developing economies, pose significant challenges.

Labour Market and Trade Dynamics

India’s labour market indicators have shown improvement, driven by robust economic growth and higher labour force participation. The country’s focus on increasing capital investment is expected to support this positive trend. Additionally, global trade is projected to recover in 2024, partly due to the destocking of inventory accumulated during previous supply-chain disruptions. Notably, China’s foreign trade has also grown faster than expected, particularly with exports to emerging markets like Brazil, India, and Russia.

Conclusion

The United Nations’ revised economic projections for India reflect a strong and resilient economy poised for significant growth. With substantial public investment and robust private consumption, India’s economic outlook remains positive despite global challenges. As the country continues to navigate through external pressures and regional dynamics, the focus on sustainable growth and fiscal stability will be crucial in maintaining this upward trajectory.