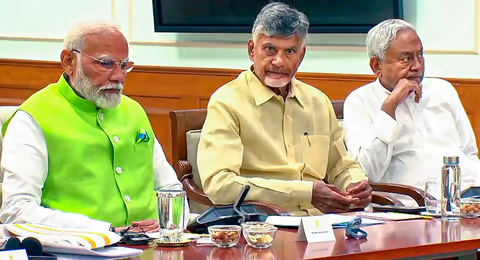

India’s return to coalition governance after a decade has led to the resurgence of old demands and the emergence of new ones, as the Bharatiya Janata Party (BJP) relies on support from the Telugu Desam Party (TDP) and Janata Dal United (JD(U)) for a third term. This coalition dynamics has significant implications, particularly regarding the demand for special category status for Andhra Pradesh and Bihar.

BJP’s Coalition Dynamics and the Role of TDP and JD(U)

Representational.

The BJP, in its bid for a third term, has been compelled to form alliances with regional parties such as the TDP and JD(U). The TDP, victorious in Andhra Pradesh, and the JD(U), holding a majority in Bihar, together contribute 29 parliamentarians, crucial for the National Democratic Alliance (NDA) to surpass the majority mark of 272 in the parliament. This coalition arrangement has brought the demands of these states to the forefront, especially the push for special category status.

Historical Context of Special Category Status

Special category status was introduced in 1969 by the 5th Finance Commission to provide central assistance and tax breaks to states disadvantaged by factors like hilly terrain, low population density, large tribal populations, and economic backwardness. This status aimed to promote equitable development by offering additional financial support to these states.

Andhra Pradesh and Bihar: Case for Special Category Status

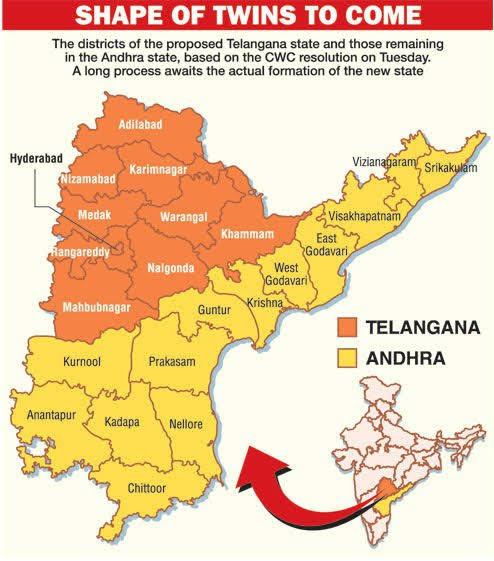

Andhra Pradesh’s Economic Challenges Post-Bifurcation

Representational.

The bifurcation of Andhra Pradesh in 2014, which led to the creation of Telangana, left Andhra Pradesh with significant economic challenges. The loss of Hyderabad, its administrative and financial capital, exacerbated the state’s financial struggles. Former Prime Minister Manmohan Singh had assured special category status to Andhra Pradesh for five years, promising additional central assistance and tax concessions. However, this commitment was not fulfilled as the Congress-led government was voted out in 2014.

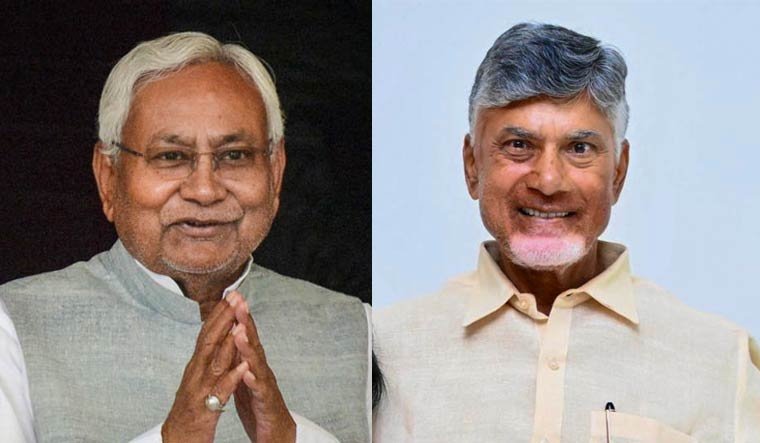

Bihar’s Struggle After Jharkhand’s Separation

Representational.

Similarly, Bihar’s demand for special category status stems from its bifurcation in 2000 when Jharkhand was carved out, resulting in the loss of a resource-rich region. The economic implications of this separation have fueled Bihar’s push for additional financial support to address its developmental challenges.

Finance Commission’s Stance and Recent Developments

Representational.

In 2015, the 14th Finance Commission, chaired by former central bank governor YV Reddy, discontinued the distinction between special category and other states. The commission increased the tax devolution to states by 10 percentage points to 42 percent, making the special category status seemingly redundant. However, North-Eastern and hilly states retained some benefits due to their unique challenges.

Fiscal Implications and Political Consequences

Representational

Potential Financial Impact

Former Finance Secretary Subash Chandra Garg highlighted the financial nuances of granting special category status. States with this status receive central funds more liberally, with around 90 percent given as grants and only 10 percent as loans. Extending this to Andhra Pradesh and Bihar could significantly increase the central government’s fiscal burden.

Political Ramifications

Granting special category status to Andhra Pradesh and Bihar could have substantial political repercussions. The redistribution of funds might lead to opposition from other states, creating a contentious and potentially inequitable situation. This decision would require careful consideration by the 16th Finance Commission, constituted in December 2023, to ensure balanced and fair allocation of resources.

Future Considerations: The Role of the 16th Finance Commission

Representational.

Lekha Chakraborty, a professor at the National Institute of Public Finance and Policy (NIPFP), emphasized the need for meticulous analysis by the 16th Finance Commission. The commission, chaired by Arvind Panagariya, is tasked with recommending the formula for tax sharing and other funds distribution between the Centre and states for five years, starting April 1, 2026. The special category status, requiring a 90:10 devolution, needs revaluation from a fiscal rules perspective.

Conclusion: Navigating Coalition Politics and Economic Demands

India’s return to coalition politics has reignited discussions on special category status for states like Andhra Pradesh and Bihar. As the BJP navigates its alliances with regional parties, addressing these demands requires a careful balance of economic and political considerations. The upcoming recommendations from the 16th Finance Commission will play a crucial role in shaping the future of these states’ economic support and development.

Representational.

By delving into the historical context, fiscal implications, and political consequences, this article aims to provide a comprehensive overview of the complexities surrounding the demand for special category status in India’s coalition governance landscape.