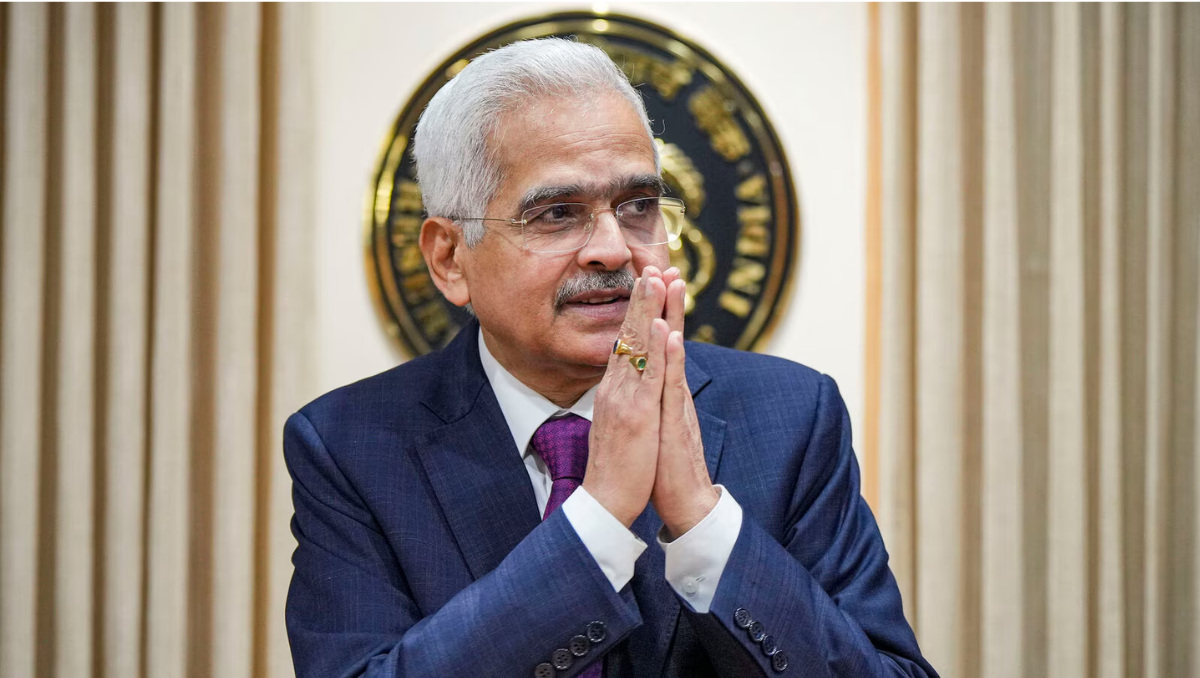

The Reserve Bank of India (RBI) has conceded that it will take effort to reach its inflation target of 4%. The intricacies of overcoming this challenge were emphasised by RBI Governor Shaktikanta Das during the most recent monetary policy review. Certain factors are making it difficult to reduce inflation to the desired level, even with concerted efforts.

Understanding India’s Inflation dynamics

For a number of months, India has been struggling with inflationary pressures. Due to a number of supply-side and demand-side disruptions, the Consumer Price Index (CPI) has been slightly above the RBI’s comfort level. Although there have been recent indications of moderation in inflation, it is still higher than the central bank’s medium-term target of 4%.

In order to control pressures associated with inflation, the RBI employs a number of policy tools to stabilise prices, as well as a cautious approach to interest rate policy. But there are still a lot of obstacles to overcome, including outside variables like changes in the price of commodities globally and geopolitical unrest.

Factors Contributing to Sticky Inflation

India continues to experience high prices due to inflationary pressures for a number of reasons. The fluctuation in crude oil prices around the world is one important factor. India is very susceptible to fluctuations in the price of oil since it is a net importer, which has an immediate effect on the cost of manufacturing and transportation. Every increase in oil prices typically causes the entire situation as a whole, to spiral out of control.

The global supply chain disruptions are another important factor. Worldwide supply chain disruptions brought on by the COVID-19 pandemic have resulted in shortages of essential supplies and products. Consumer prices have increased as a result of these disruptions’ increase in production costs.

RBI’s Strategies

The RBI has chosen a multifaceted strategy to overcome this challenge. In order to assist the economic recovery, the central bank has maintained interest rates at accommodative levels while continuing to monitor inflation risks. In order to maintain sufficient liquidity in the financial system, which aids in containing inflation, the RBI has also used liquidity management tools.

In addition, the government and the RBI have been collaborating closely to address structural problems such as fuel price hikes. This includes actions to raise the efficiency of the supply chain, increase agricultural productivity, and maintain food prices. In order to lessen external shocks, the central bank also keeps an eye on developments in the world economy and modifies its policies as necessary.

Future Outlook and Challenges

The RBI is still committed to hitting its 4% target in spite of the difficulties. Governor Das stressed that the central bank will keep using all of the resources at its disposal to successfully control inflation. But reaching this objective calls for concerted action from the fiscal and monetary authorities.

A gradual path to 4% inflation is anticipated in light of the ongoing supply-side obstacles and the dynamic global economic landscape. The goal of the RBI’s policy framework is to support economic growth while preserving price stability, which is a difficult balance to strike.

The central bank will be keeping a close eye on inflationary trends in the near future and will be prepared to modify its policies as necessary. Maintaining trust in the RBI’s policy measures and controlling inflation expectations will also heavily depend on communication and transparency.

2 Comments

Pingback: India's Wholesale Inflation Hits 15-Month High at 2.61%

Pingback: Government Capex vs. Corporate Investment: Striking Balance