President Mohamed Muizzu has shifted the nation’s focus from Beijing to its longtime

sponsor, India, after taking office last year.

IMF Warns Maldives

Last month, his party used Chinese funds to build thousands of apartments, recover more

for urban renewal, and modernize airports, all of which helped them win parliamentary

decisions in an avalanche.The IMF stated that the Maldives remained “at high risk of

external and overall debt distress” in the absence of “significant policy changes,” without

mentioning the primary lender to mentioning the primary lender to the archipelago.

“The IMF said in a statement that “the outlook remains highly uncertain, and risks have shifted to the downside, including delayed fiscal consolidation and weaker growth from main sources of tourism.”

The Maldives has been advised to immediately raise its revenue, cut expenditure and restrict

the use of external funds in order to avoid a serious financial crisis. The Maldives is tiny

country made up of 1,192 tiny coral islets that are dispersed 800 kilometers (500 miles)

around the equator. However, it is ideally located to cross important international shipping

lanes that run east-west. Tourism, which includes white sandy beaches and remote resorts

offering Robinson Crusoe’s style of vacations, is a major source of foreign money for the

country.

Shift of President Muizzu to Beijing Raises Economic Concerns

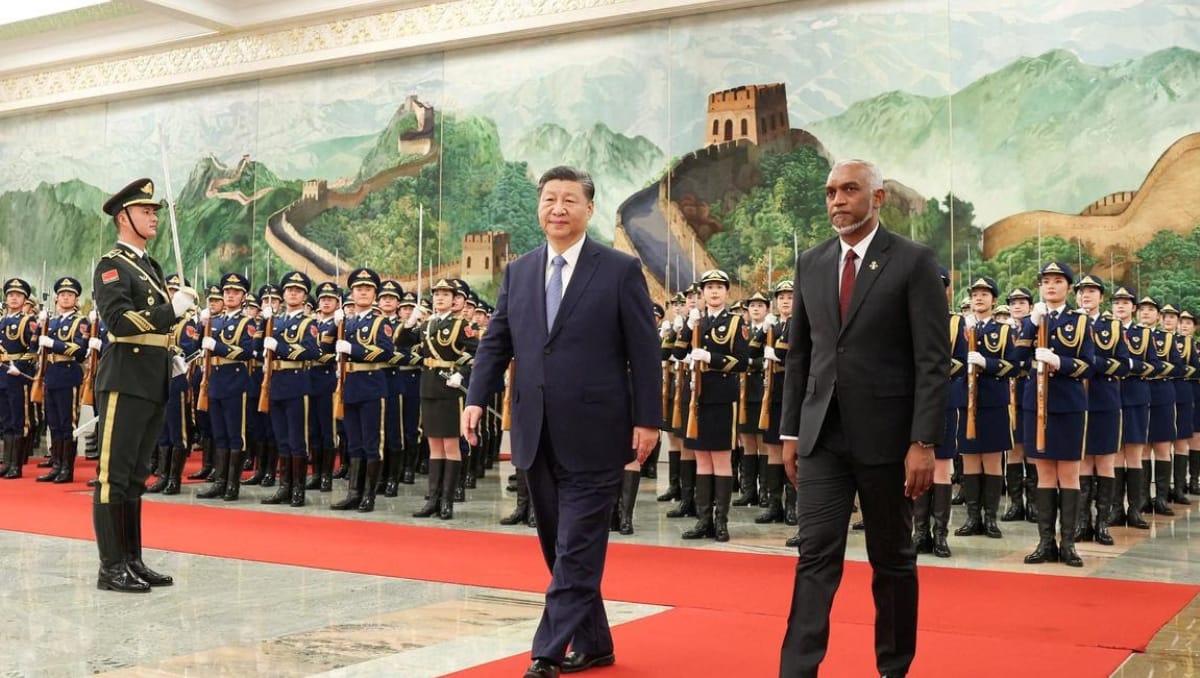

Since Muizzu’s win last year, China has increased its financing commitments. Muizzu hailed

China for its “selfless assistance” for development funds during an official visit to Beijing

immediately after he assumed office. According to official data, the Maldives’ foreign debt

increased by about $250 million from 2022 to $4.038 billion last year, or roughly 118 percent

of GDP. According to data from the Maldives finance ministry, as of June 2023, the

Export-Import Bank of China held the largest share of the nation’s external debt, at 25.2%.

Image Source: The Hindu

Maldives is in high risk of external debt

Debt-ridden next door In 2022, following a foreign exchange crisis that resulted in months of

food and fuel shortages, Sri Lanka fell behind on its foreign debt. China is the beneficiary of

more than half of Sri Lanka’s bilateral debt, and the island nation is still having difficulty

reorganizing its debt with IMF Fund support.

In 2017, Sri Lanka gave up control of the facility to a Chinese state corporation on a 99-year lease after being unable to repay a sizable Chinese loan used to construct a port in the country’s south. Concerns were raised by the agreement over Beijing’s potential exploitation of “debt traps” to expand its influence overseas, particularly in the Indian Ocean