By 2030, India will offer enormous investment potential valued at more than $500 billion, especially in the clean energy value chain, which includes green hydrogen, EVs, and renewable energy sources, the Commerce Ministry stated on Thursday.

Sunil Barthwal, the commerce secretary, made this statement during the two-day Indo-Pacific Economic Framework for Prosperity (IPEF) Clean Economy Investor Forum meeting in Singapore. The summit’s purpose, which got underway on Wednesday, was to mobilize funding for initiatives including renewable energy, climate technology, and sustainable infrastructure. The attendees included leading investors, clean economy firms, and start-ups.

Barthwal recognized the first IPEF Clean Economy Investor meeting as a special venue that brought together policymakers, scholars, and international investors. He said this will help advance sustainable infrastructure in the Indo-Pacific region.

IPEF

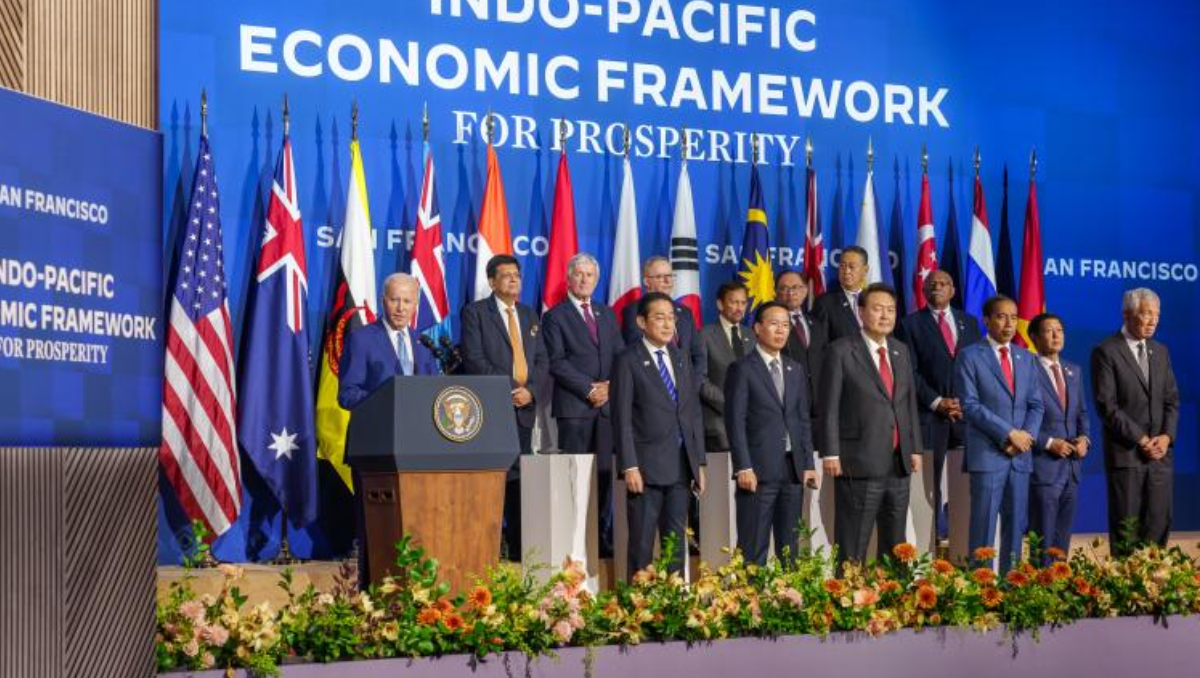

On May 23, 2022, in Tokyo, the US and other Indo-Pacific partner nations jointly established the 14-member IPEF group. Taken together, they make up 28% of trade and 40% of the global economic output.

The framework is organized around four pillars: trade, supply chains, a clean, and equitable economy. Except for trade, India has joined all the pillars.

Members of the bloc are the US, Vietnam, Australia, Brunei Darussalam, Fiji, India, Indonesia, Japan, the Republic of Korea, Malaysia, New Zealand, Philippines, Singapore, Thailand, and the United States.

India at the Forefront

During the forum, the secretary emphasized the vast investment prospects that India provides, specifically in the clean energy value chain that includes renewable energy, green hydrogen, electric vehicles, and their infrastructure transition, with a potential value of over $500 billion by 2030. Barthwal also outlined significant changes made to India’s business environment in the last ten years to boost ease of doing business.

Over the course of two days, the sustainable infrastructure and climate tech engagement tracks drew in a diverse crowd of over 300 participants.

These included representatives from various government agencies, financial institutions, multilateral development banks, venture capital funds, project owners, and entrepreneurs, all of whom were IPEF partners. This wide-ranging participation underscores the significance and reach of the forum.

After the review, “four companies (ReNew Power, Avaada Energy Pvt Ltd, Indusbridge Capital Advisors LLP. Founder, SEIP, and Powerica Ltd) from India, were chosen, for pitching proposals on energy transition, transport and logistics, and waste management/waste to energy to global investors,” the Ministry said regarding the sustainable infrastructure track.

Similarly, in the climate tech track, ten Indian startups and companies were chosen to pitch their creative ideas, technologies, and solutions that help mitigate or adapt to climate change. These companies and startups include BluSmart, Recykal, LOHUM, Sea6 Energy, EVage Ventures, Kabira Mobility, Batx Energies, Newtrace and Alt Mobility, and igrenEnergi, Inc.

The Ministry added that the event generated $23 billion in investment prospects for sustainable infrastructure projects in the Indo-Pacific region. The coalition projects that the combined money of its members might be used in the upcoming years to invest in infrastructure in emerging markets in the Indo-Pacific region. This capital amounts to about $25 billion. Additionally, the Development Finance Corporation (DFC) Board has approved an equity investment as part of the $900 million Eversource Climate Investment Partners-II fund. The fund will encourage innovative companies in India and Southeast Asia by providing capital, management, and expertise using both new and existing capabilities to address climate change.

The IPEF Catalytic Capital Fund, which will provide concessional funding, expertise, and capacity-building support to expand the pipeline of high-quality, resilient, accessible, and equitable clean economy infrastructure initiatives in emerging and upper-middle-income economies, was also announced by the Private Infrastructure Development Group and IPEF partners. One such development project in development is a renewable energy platform in India.

With a $33 million initial grant planned to spark up to $3.3 billion in private investment, Australia, Japan, Korea, and the US are among the fund’s founding sponsors.

Another significant development was the signing of a 200 KTPA (kilotonne per annum) green ammonia production and export deal. This deal, involving Kyushu Electric, Sojitz, and Sembcorp Green Hydrogen India, is a testament to the growing global shift towards sustainable energy and environmental initiatives. Under the terms of the deal, Tuticorin Port in India will produce and export 200 KTPA of green ammonia in Phase -1 (a total of 800 KTPA over four phases) to Japan.

The project would help India achieve its goal of becoming an international hub for the production and export of green hydrogen and its derivatives by advancing the National Green Hydrogen Mission.