The recent spike in trading values in Indian Market has alarmed brokerage Nomura, which views it as a contrarian development and does not completely rule out the prospect of an “air pocket” for Indian stocks.

Despite growing concerns about valuations, trading volumes for Indian Markets have surpassed those of the Hong Kong exchange, indicating a generally positive outlook for Indian equities.

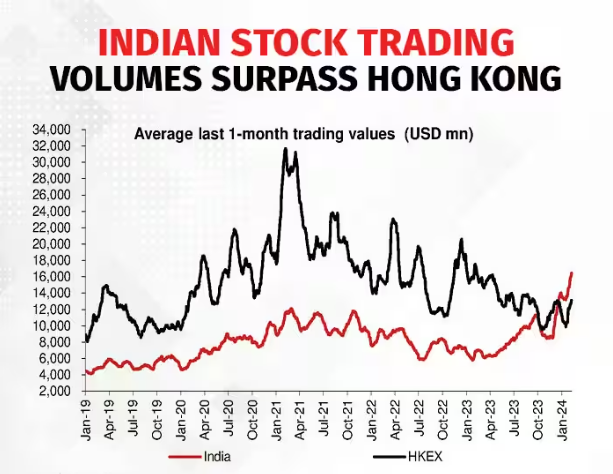

Over the course of a month, the combined daily trading value of Indian stocks on the BSE and NSE was $16.5 billion, while Hong Kong’s daily trading value was $13.1 billion.

This number is very different from Hong Kong’s. It not only shows a significant overtake that happened in September, but it also shows a widening disparity between the two, highlighting a more general shift in investor sentiment throughout Asia.

On the other hand, there has been a noticeable change in the attitude of investors in the Chinese market. As China‘s economy slows, billions are being withheld. India and indian markets , the major economy with the fastest growth, concentrates on expanding its infrastructure to draw in foreign investment. The divergent trajectories underscore economic obstacles in China’s and India’s endeavors to expand amidst a shifting worldwide framework.

China, which is facing severe economic difficulties, has injected $140 billion into banks, launched a $278 billion plan to save the stock market, and is attempting to resolve problems in the real estate industry. A US research firm projects slower growth for China, ranging from 3 to 4 percent, despite the country’s GDP growth exceeding 2023 expectations. The firm attributes this to unresolved structural issues, such as local government debt, and limited progress in attracting foreign investment.

The combination of low returns from the China market and volumes in Indian markets exceeding those in Hong Kong suggests that investor interest in Hong Kong/China equities is muted. The Shanghai index has dropped for the past two years, and Hang Seng has produced negative returns for the fourth consecutive year. The Shanghai Stock Index fell 3.5 percent so far in 2024, while the Hang Seng index fell by almost 6.8 percent. Shanghai lost 3.7 percent and Hang Seng lost 13.8 percent in 2023.

The US Federal Reserve‘s recent pivot, the global stock market’s surge, and the favorable outcomes of state elections all contributed to Indian markets combined daily stock trading value rising to Rs1.4 trillion (5DMA basis). Notably, increased participation in non-institutional trading is another factor driving the surge.

Positive outlook from the interim budget, which maintained important government commitments, also helped to boost investor confidence. While maintaining fiscal prudence, Budget 2024 seeks to achieve significant economic growth, the development of infrastructure, and sector-specific initiatives. With a focus on inclusive development, green growth, and innovation, the government wants to see India through to developed status by 2047.

The recent spike in trading values in India has alarmed brokerage Nomura, which views it as a contrarian development and does not completely rule out the prospect of an “air pocket” for Indian stocks.

A cyclical economic slowdown, earnings downgrades, worries about tighter banking sector liquidity, profit-taking ahead of general elections, stretched investor positioning and valuations, and possible reallocation of flows to other Asian markets like Korea and China are just a few of the potential triggers for a pullback that Nomura identified.

Nomura, on the other hand, is still structurally positive and views any decline as a chance to buy the dip.

The cash segment saw a notable uptick in December and January, when it averaged a record-breaking daily turnover of Rs 1.20 trillion on the BSE and the NSE per month.

Since April 2023, the Indian markets have risen sharply due to improved economic conditions, a robust economy, rising wages, political stability, and anticipated declines in inflation. Investments, both domestic and foreign, improved sentiment even more

The performance of major indexes highlights the trend: in 2023, the NSE Nifty 50 Index in India posted a 20% return, marking its eighth consecutive year of gains; in contrast, the Hang Seng Index in Hong Kong saw a decline for the fourth consecutive year. This discrepancy is indicative of the changing tastes of international investors, who are starting to see India as a competitive contender for their investment plans in place of China. .