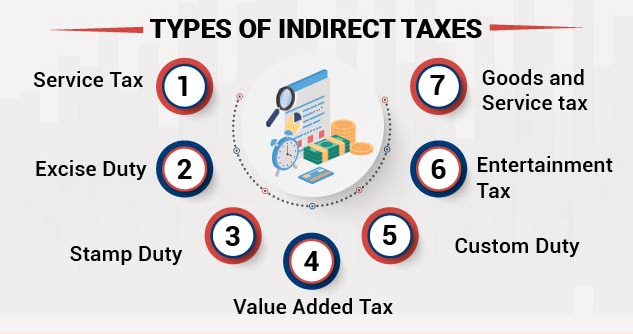

The economic development of India, has been greatly aided by indirect taxes, where a disjointed indirect tax system has been replaced.

The Finance Minister’s Vote-on-Account, which was unveiled on Thursday, is a transitory budget before the general elections. After the election, perhaps in July, the incoming Cabinet will probably present a comprehensive budget. In his speech, the Finance Minister emphasized the progress India’s economy has made in becoming the third largest in the world and rapidly approaching its target of $5 trillion over the next three years.

The Finance Minister’s Vote-on-Account, which was unveiled on Thursday, is a transitory budget before the general elections. After the election, perhaps in July, the incoming Cabinet will probably present a comprehensive budget. In his speech, the Finance Minister emphasized the progress India’s economy has made in becoming the third largest in the world and rapidly approaching its target of $5 trillion over the next three years.

Another major sign of the state of the economy, the GST collections for January 2024 are the second highest since July 2017, according to data released on January 31.

The Finance Minister mentioned in her speech a Deloitte survey that offered insights into the sixth year of the GST. The industry was consulted for this survey, and responses indicated that the government’s proactive efforts to streamline compliance were vital to the smooth implementation of the GST. The results of the survey showed that doing business in India is becoming easier thanks to improved supply chain efficiencies, working capital rationalization, lower input costs, etc. Positive feedback was also given to the ongoing emphasis on efforts aimed at streamlining and optimizing tax technology. According to the survey results, MSMEs have been having trouble with e-invoicing and meeting the requirements to receive input credits,

Hailing the remarkable change in tax administration since the GST regime was implemented six years ago, Deloitte India carried out a survey to get India Inc.’s opinions on this revolutionary tax reform for the second year in a row. According to the survey, eighty percent of business leaders believe that the next round of GST regime reforms is about to happen for improved EoDB and sectoral growth in the coming years.

whereas large taxpayers have been able to adjust to the technological tools introduced by the GST.

The budget has provided clarity on the application of the Input Service Distributor (ISD) and cross-charge mechanism by amending pertinent GST law provisions to make the ISD mechanism mandatory going forward. This aligns with the suggestions made by the GST Council during their most recent gatherings.

Under Customs, steps have been taken to shorten the time it takes to clear goods. At inland container depots, the import release time has decreased by 47% to 71 hours, at air cargo complexes by 28% to 44 hours, and at sea ports by 27% to 85 hours. resulting in optimization of the supply chain. Recently, changes were made to lower customs duties on mobile phone components and extend duty concessions on lithium-ion batteries for mobile phones. These changes aim to help the smartphone industry become more globally dominant by enabling lower-cost imports of componentry.

The industry anticipated that in order to lower litigation and digitize the Customs litigation procedures, among other things, an amnesty program could likely be implemented under Customs law. The entire budget, which will be presented following the elections, might address these expectations.

The economic development of India, where a disjointed indirect tax system has been replaced, has been greatly aided by indirect taxes. Since certain groups (MSMEs and smaller players) find it difficult to navigate the regulations, compliances could be made easier.This would make doing business in India easier.