The Eurozone seems to be grappling with disinflation, a process that is proving to be more complex and turbulent than anticipated. The President of the European Central Bank, Christine Lagarde, has emphasized that the journey towards stabilizing inflation will be fraught with challenges. This sentiment is echoed by other ECB officials, who highlight the persistent issues within the region’s economic landscape.

A Turbulent Path to Eurozone Price Stability

In an effort to reduce inflation to predetermined levels, Christine Lagarde has been vocal about the challenges facing the Eurozone. The term “disinflation” refers to a slowdown in the rate of inflation, which, while less severe than deflation, still poses significant risks to economic stability. Since Lagarde labelled the process “bumpy,” there will probably be sporadic setbacks for the Eurozone.

Variations in energy prices, member state economic recovery rates, and geopolitical tensions all have an impact on this rough journey. The ongoing turbulence in global markets, coupled with internal challenges, means that the ECB must remain vigilant and adaptable.

ECB’s Battle with Core Inflation: A Sticky Situation

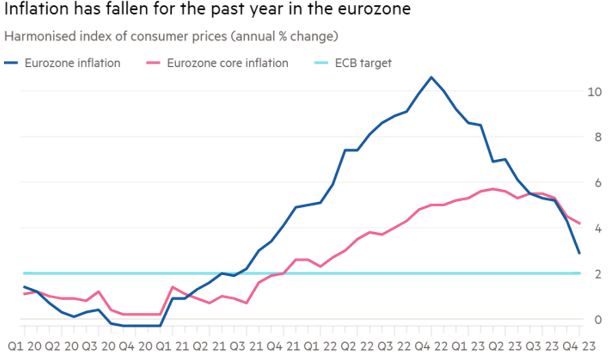

One of the main concerns expressed by ECB officials, particularly Bundesbank President Joachim Nagel, is the ongoing trend of core inflation. Core inflation presents a more accurate picture of long-term price patterns by excluding volatile goods like food and energy. According to Nagel, core inflation is still “very sticky,” indicating that underlying price pressures are not easing as quickly as would be ideal.

Several factors can be attributed to this stickiness, such as supply chain interruptions and wage growth. Rising input costs are passed on by businesses to their clients, maintaining inflationary pressures. The need to strike a balance between actions that are aimed at overcoming inflationary pressures and don’t impede economic growth makes the ECB’s job more difficult.

Monitoring Market Reactions

The European Central Bank is keeping a careful eye on market responses, particularly in light of the recent economic unrest in France. Lagarde has given her word that the ECB is ready to intervene if warranted to maintain market stability and promote economic growth. In order to control inflationary expectations and preserve financial stability, this involves modifying interest rates and putting other monetary policy measures into practice.

Martins Kazaks, a member of the ECB Governing Council, has emphasized that inflationary concerns must be resolved by 2026. This long-term perspective emphasizes how important it is to implement timely and successful policy changes. The ECB’s strategy entails a thorough evaluation of the state of the economy and a willingness to move quickly to address new issues.

Long-Term Outlook and Strategic Adjustments

In the long run, the ECB is concerned with preventing deflation from turning into disinflation, which may have disastrous effects on the economy. The goal of the ECB’s strategic reforms is to promote an environment of economic stability that facilitates sustainable growth. This entails coordination with national fiscal policies in addition to monetary policy initiatives.

The ECB’s proactive approach demonstrates its dedication to a stable Eurozone. The European Central Bank (ECB) endeavors to manage the intricate terrain of deflation while averting any hazards by regularly observing economic data and market circumstances. The way forward calls for a careful balancing act on policy measures in order to attain sustained economic stability.

In summary, the Eurozone’s journey towards disinflation is marked by significant challenges and uncertainties. The ECB, under the leadership of Christine Lagarde and other key officials, is focused on navigating these complexities through strategic policy adjustments and vigilant market monitoring. The ultimate goal is to achieve a stable inflation rate that supports economic growth and stability across the Eurozone.

1 Comment

Pingback: UK Inflation Persists at 2% for the First Time Since 2021