The need for reasonably fit labor during the war has forced civilian industries to raise prices for labor that is in short supply. The Russian central bank had to increase the benchmark interest rate to 16% in order to control inflation, which put additional pressure on the private sector.

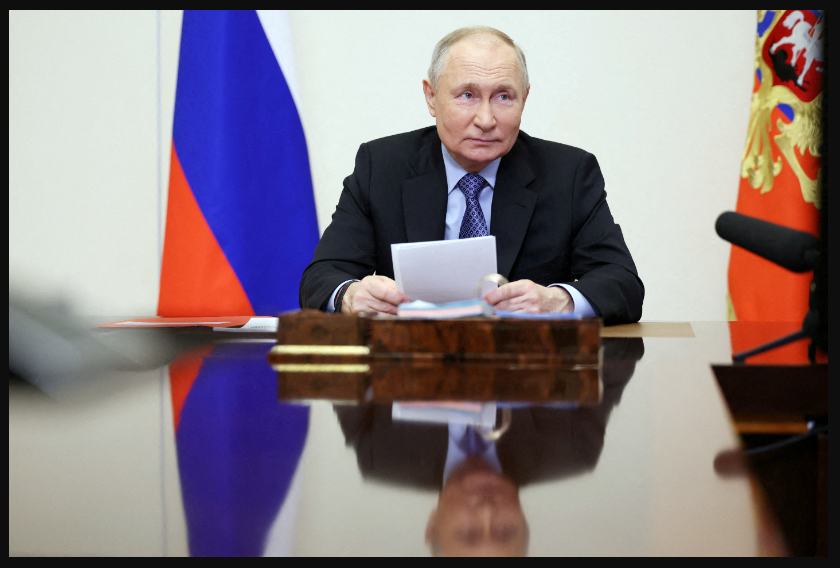

The world is led to believe by Vladimir Putin that Russia’s economy is booming and that he has the resources to continue fighting the war in Ukraine indefinitely.

The government has an annual budget deficit of roughly $17 billion, its borrowing power is limited if domestic banks are the only lenders available. As corporate borrowers are burdened by exorbitant interest rates, those same banks are becoming more and more vulnerable to losses.

Two years prior, on February 24, Putin invaded Ukraine, having laboriously constructed Russia’s financial and fiscal fortifications, which were an essential component of his own hold on power. Sovereign debt was among the lowest of all countries, at only 16 percent of GDP. As opposed to significant and ongoing deficits in the US and Europe, the government was operating a budget surplus in the second year of the pandemic. It had amassed over $500 billion in foreign reserves at its central bank and a $175 billion “national wellbeing” fund. When compared to their international counterparts, the biggest banks had adequate capital.

In order to finance the war and maintain the economy in the face of Western sanctions, Putin has now drastically altered his course. The amount spent on the military has increased from 3.6 percent of GDP in 2021 to an estimated 7.1 percent, driving up the production of computers and artillery shells alike. The poorest families’ fortunes have improved due to the soldiers’ salaries and death benefits. Russians have been able to spend lavishly on new apartments thanks to more than $130 billion in subsidized loans, which has led to a boom in building. As a result, despite forecasts of a protracted recession, real GDP growth recovered to 3.6 percent last year.

It’s clear that this kind of “military Keynesianism” has its limitations. The unemployment rate has dropped to an extremely low of 2.9 percent as a result of the war’s consumption of able-bodied workers, forcing civilian industries to pay more for scarce labor. The central bank had to increase the benchmark interest rate to 16 percent in order to control inflation, which put additional pressure on the private sector. The GDP won’t increase due to military spending alone; in order to keep it at its current level, significant compromises in other crucial areas, like social spending and urgently needed infrastructure maintenance, would have to be made. Russia would have had far less impressive economic results if not for the war-related stimulus.

Even worse for Putin, he is quickly undermining the barriers he built to shield the economy and himself from unanticipated shocks. In the West, a large portion of the central bank’s reserves are frozen. Since the start of the war, the National Wellbeing Fund’s liquid assets have decreased by almost half, to a total of $55 billion. The government faces an approximate $17 billion annual budget deficit, and if domestic banks are the only lenders available, there will be little use for its borrowing capacity. As corporate borrowers are burdened by exorbitant interest rates, those same banks are becoming more and more vulnerable to losses.

The West faces its own financial challenges. Governments in the US and Europe must control growing sovereign debt and budget deficits. Although difficult decisions will need to be made, the temporary funding needed to support Ukraine is by no means final. When combined, the fiscal resources of NATO members surpass those of Russia by a factor of over twenty. Members of the European Union spend, on average, 2% of their GDP on defense.

Negotiations will most likely be used to end this war. A secure and independent Ukrainian state should be the priority for the West, and they should also want to discourage other people from trying to seize similar territory. In order to achieve this, it ought to take full advantage of Putin’s financial weakness, especially by strengthening sanctions and arming Ukraine. The West has the resources to outlast him, if they have the political will to do so. They ought to take advantage of this advantage and put an end to the carnage as soon as is practical.