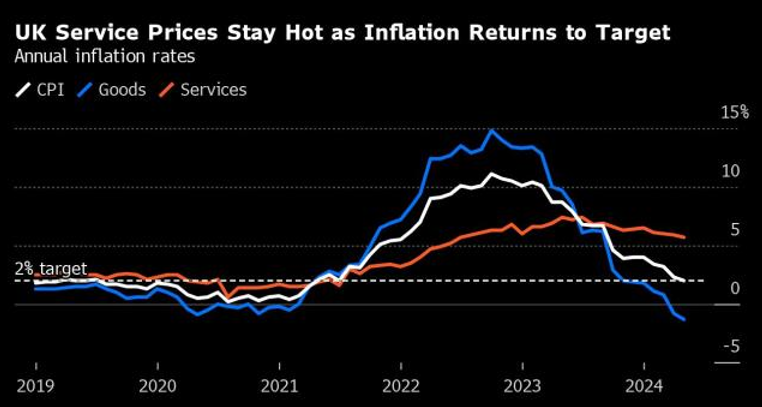

For the first time since 2021, the United Kingdom has achieved an inflation rate of 2%, a figure that aligns with the Bank of England’s long-term target. This milestone marks a notable shift from the high inflation rates that have been prevalent in recent years, reflecting a period of economic stability and controlled price levels. Achieving this target has several significant economic implications domestically.

Balancing Growth and Price Stability

A 2% inflation rate is generally considered optimal as it indicates a stable economic environment where consumer prices rise moderately. This stability helps maintain consumer purchasing power. When inflation is too high, consumers’ real incomes are eroded, leading to decreased spending power. Conversely, deflation can lead to reduced spending as consumers anticipate falling prices. At 2%, consumers can plan their spending more effectively, fostering confidence and potentially increasing consumption, which in turn supports economic growth.

Moderate price levels are also favorable for the investment climate. Investors prefer predictable and stable inflation rates because they reduce the uncertainty associated with long-term investment decisions. When the rate is at 2%, businesses can plan for the future with greater confidence, knowing that input costs and selling prices are likely to remain stable. This environment can encourage both domestic and foreign investment, driving economic development and innovation.

Inflation Target and Monetary Policy: A Symbiotic Relationship

By achieving the 2% target rate, the Bank of England is less pressured to implement drastic changes in interest rates. During periods of high inflation, central banks often raise interest rates to curb spending and borrowing, slowing down the economy. Conversely, they might lower rates to encourage borrowing and investment. At 2%, the central bank can maintain a neutral stance, keeping interest rates stable, which benefits borrowers and savers alike by providing a predictable financial environment.

Stable inflation allows for a reassessment of unconventional monetary policies such as quantitative easing (QE). QE has been used extensively since the 2008 financial crisis and during the COVID-19 pandemic to stimulate the economy. With inflationary pressures under control, the Bank of England can gradually unwind these measures, ensuring that the financial system remains robust without the need for extraordinary interventions.

Long-Term Economic Planning in a Low-Inflation Context

Achieving price stability has the potential to positively influence wage growth and employment levels. When inflation is predictable, businesses are more likely to implement sustainable wage increases. This stability supports the labor market by reducing the pressure on companies to make abrupt changes in employment or wages in response to fluctuating prices. Consequently, employees enjoy better job security and more consistent income growth, enhancing overall economic well-being.

The government benefits from stable inflation through more predictable tax revenues and expenditures. High inflation can erode the value of tax revenues, while deflation can increase the real burden of public debt. At 2%, the government can plan its budget more effectively, ensuring that public services and infrastructure investments are maintained without the disruptive effects of volatile price levels.

Ripple Effects and Global Implications

Moreover, stabilizing inflation strengthens the British pound, as it signals a healthy and stable economy. Currency stability attracts foreign investors looking for safe and predictable returns. A strong pound can influence trade balances, making UK exports more expensive but imports cheaper, potentially impacting global trade dynamics. Global investors monitor inflation rates as indicators of economic health. The UK’s achievement of its target may attract increased foreign direct investment as investors seek stable environments. This influx of capital can enhance the UK’s economic growth prospects and create a positive feedback loop of investment and development.

The UK’s inflation stabilization can influence global monetary policy trends. Other central banks may look to the Bank of England’s strategies as models for achieving similar stability. This could lead to a more coordinated approach to global monetary policy, fostering international economic stability.